Can you believe that it’s already April 2022? Christmas 2021 and Chinese New Year 2022 didn’t seem too long ago.

Truth be told, I’ve just written my goals for 2022. So, if you haven’t planned for 2022 yet, you can still do it!

The year 2022 is finally the year to have a good time. More pleasure with less work! (Hopefully)

There’s no going back to the way things were before. It’s time to make a change if you’re still unhappy at work, in an unhealthy relationship, or with your general lifestyle.

I’m hoping you’ll also share your goals with me as I share mine with you!

Personal Finance Goals for 2022

Money is just a tool to get to my goals.

Even though most of what I share on my TikTok and blog is about personal finance, the truth is that we want money so that we can live the life we want.

We want to generate enough passive income to support our desired living expenses.

1. Grow net worth by 8%

This figure is not impossible to hit, as I am able to generate approximately 12% from my peer-to-peer lending investments.

We should look at properties as a long-term investing strategy.

I plan to sell the unit that’s producing a rental interest of 3.8% within the next 5 years (flip) and reap my capital gains.

I will also increase my rental for the unit which is giving 6.4% rental interest in the next 2 years.

Currently, I’m only renting it out at 6.4% since it’s post-pandemic, and I understand that it’s not easy for my tenants.

Looking at my current rate of monthly income, saving, and investing, growing my net worth by 8% is absolutely possible.

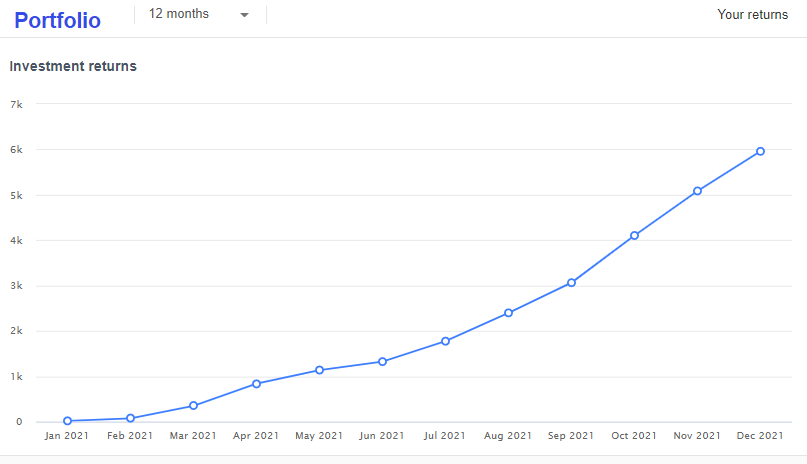

2. Generate RM6000 in online investment income annually!

That’ll be RM500 per month. Is it doable? I hope so.

Rather than focusing on how much I will generate from my online investments, I’d like to view it as the number of people that will be impacted by my sharing.

A big hug and thank you to you who are reading my blog/emails/watching my Tiktoks.

Let’s be financially free together!

3. Give more money to charity/church/non-profit organizations with a cause.

Currently, I’m giving around 13% of my monthly salary to support people in need.

I love giving and blessing people, especially those whose situations are dire.

I’d like to increase my giving this year to probably around 15 – 20%.

Here are some of the organizations that I support:

- Name: Mobilisation Fellowship (M) Bhd

Bank: Maybank, 5141-9601-8478

Email: finance.my@om.org

Website: https://www.facebook.com/OMinMalaysia/ - Name: TKPP DESA AMAL JIREH

In short for: Tabung KEBAJIKAN dan Pendidikan Pertubuhan DAJ

Bank: Public Bank, 3123 8094 27

Email: desaamaljireh@gmail.com

Website: www.daj.org.my

4. Investing in 1 – 2 real estate properties this year.

The real estate market is a little shaky lately.

I am still a firm believer in buying good and valuable real estate properties at a discounted price.

Stocks are volatile, you can see the stock prices deviate by 20% a day and people would either buy/sell stocks crazily; but you don’t generally see people selling (lelong) their properties within a day when the valuation goes down by 20%.

If you’re someone who has a weak heart, probably real estate would be a better investment strategy than stocks.

5. Learning how to invest in the Malaysian / USA stock markets.

Whether it’s stocks or real estate, the key is to own good ones at a lower valuation.

However, I will not purchase IPO ever. Period.

The last IPO I bought didn’t make a single cent, and it’s been more than 6 years already. (I did not listen to Warren Buffet & my father’s advice about IPOs many years ago).

Hopefully, I wouldn’t even lose my capital to that IPO – it’s a tech stock by the way.

6. Learning to invest in cryptocurrencies & NFTs.

Crypto and NFTs are surely a new hype!

I do believe that the digitalization of money in the future is something we couldn’t avoid moving forward.

Think about it, back then people thought that cash is king! The more cash you have on hand, the better it is.

If you’re able to buy a car/house in cash, fabulous!

After that, we slowly move toward credit cards – do you remember older people said “Don’t get a credit card! It’s bad debt?”

(we all know that credit cards can be of good use when managed wisely)

Moving forward, I guess the digitalization of money will become more and more common.

However, in my humble opinion, cryptos and NFTs are very volatile.

Most of the coins and NFTs have lost 90% of their original value. Although people make a lot of money through it, many lost their money too.

Do your own research before investing!

Career Goals for 2022.

I have a full-time job as a Human Resource Executive in a public listed company in Malaysia. Work is tough.

Being a HR isn’t easy as well, given the fact that resignation rates are sky-high. (I’m super grateful to have this opportunity to grow together in this company.)

With that being said, I need to prioritize and manage my time better, I have much on my plate:

- Manage my portfolio (properties and Peer-to-peer financing).

- Learning to invest in stocks & cryptos.

- Building my online business.

1. Level up to be a better HR.

Most people have these perceptions:

- HR is not their friend.

- HR only thinks for the benefit of the company.

I’d love to break that stereotype. Yes, HR does have to think for the company, however, have you ever seen a HR fighting for your rights too as an employee?

2. Work on the side hustle for around 10 hours a week.

As much as I love my stable job, I strongly believe that people should have multiple streams of income.

(If you haven’t started investing yet, you may start with the low risk, low capital Peer-To-Peer investments.)

Read more about my portfolio here.

Therefore, I invest in different classes of assets.

This year, I will also focus on building up my side hustle. Hello, solopreneur/entrepreneur!

3. Create successful templates

In order to be financially free, you need to know your budgeting and spending habits.

Thus, I would like to help you to track your net worth, spending, and budgeting by creating these fabulous excels for you! Stay tuned!

Rainbow’s Life Goals for 2022

Great! We have finance and career goals written. Let’s not forget our own life goals too.

1. Time with family

I was working abroad as a volunteer for almost 2 years. Within those 2 years, the Covid-19 pandemic happened in the second year.

Life was tough.

I waited for many months before I was granted the opportunity to come back to Malaysia, the journey back itself took 11 days! Just imagine transiting for 11 days, no joke.

Anyway, it’s a kind reminder to all that life is unpredictable and time with loved ones is precious.

Never go to sleep angry, always love and forgive.

Spend more time with your loved ones. You never know what will happen tomorrow.

2. Be an athlete

As we grow older, I feel like our bodies are not as active as before.

Rather than pinpointing how much weight you need to lose, being an athlete seems more healthy, tangible, and sustainable!

3. Be a better communicator

One of the best things in life is to be able to clearly communicate your thoughts to yourself first, then to the world.

Writing down and planning ahead seems to help with being a better communicator.

4. Visiting some of my best friends in the USA / Ecuador / Germany / Mexico this year.

Who looks forward to taking vacations this year?! Woohoo!

It’s been wayyyyy too long.

The biggest goal for 2022: Enjoy life and have fun!

I came to the realization that having fun is the best way to achieve your goals! What’s the point of being grumpy anyway?

Enjoy your life, spend time with family, work hard, invest hard, and play harder!

If you never try, you’ll never know (good & legal stuff, I mean).

Readers, what are some of your goals for 2022? Please share them as I’m always looking for ideas and motivation.

This blog is made to discuss ways of being financially free. Sign up to receive complimentary information 🙂