Investor: “How do I get higher returns from my investments?”

Businessman: “I need lots of cash for my business turnover and borrowing from the banks isn’t the best way.”

Thus the concept of Peer-To-Peer Financing (P2P) was born!

In layman terms:

P2P helps Small and Medium Enterprises (SMEs) who require quick financing to partner up with investors who are willing to invest in their companies and regulates the risks through a pooling system.

To diversify, a person/investor wouldn’t invest RM50K or more in a single company.

So a pooling system of money through many investors would help diversify the risks and opportunities.

While at the same time, the SMEs are able to collect their funds, run/expand their businesses.

Most people are familiar with real estate, stocks, mutual funds investments, but what is P2P?

What is Peer-To-Peer Financing?

Peer-To-Peer Financing is an emerging and vibrant platform that connects SMEs that require financing and investors who are looking for high-yielding venture vehicles in Malaysia.

In 2016, the Securities Commission (SC) endorsed six P2P administrators in Malaysia.

One of them is Funding Societies.

Why did I choose to invest in Funding Societies and not other platforms?

Well honestly I would invest in other platforms too, it’s just that Funding Societies is the biggest platform here in Malaysia.

There are many opportunities to invest within Funding Malaysia too.

My Personal Journey with Funding Societies

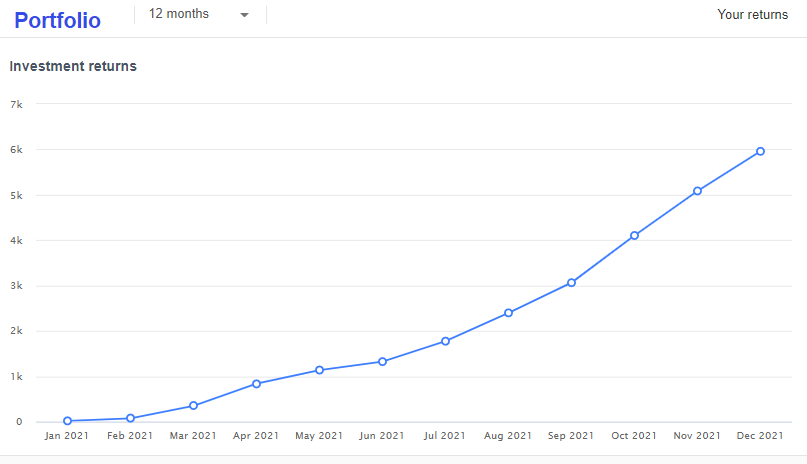

I personally have invested heavily into Funding Societies and have earned quite a handsome sum within the last 12 months. I only started investing in FS on 4 January 2021!

PS: Keep reading to find out how much I made through FS! 🙂

The Pros of investing in P2P, Funding Societies:

What entices me most about P2P Financing, primarily Funding Societies (FS) are:

- Low barrier of entry: You can start investing as low as RM100.

- No emotional roller coaster: Unlike stocks prices which go up and down because of the sentiment of ‘the market’.

- Guaranteed returns: If you have NO TIME to analyze a company, you can invest in their guaranteed returns products.

- High returns: You can get as high as 15% yields.

- Trustee agency: Investors’ funds are collected in a trustee agency to secure the investors’ money in case anything goes wrong.

- Max issuer exposure: You can limit exposing/investing too much in a single company through diversification.

- Auto Invest: Let your investments run AUTOMATICALLY with their auto-investment bot settings!

- Liquidity: The shortest period of exposure in investing is only 1 month! There are also NO fees incurred when transferring money from your bank account into FS.

The Cons of investing in FS:

- Defaults: If you do not know what you’re investing in, there are chances of defaults (just like every other type of investment!)

- Liquidity: You will have to complete the financing term before withdrawing your money!

OK, now let’s dive into the juicy part of investing!

#1: What’s Funding Societies?

Launched in 2015, Funding Societies is Southeast Asia’s largest digital financing platform with over 200,000 investors!

Funding Societies is the main as well as the largest P2P administrator in Malaysia.

They have successfully crowdfunded and disbursed RM6.35 Billion (updated March 2021).

#2: Types of Investments:

Investors can choose to invest in these different types of notes within Funding Societies:

- Business Term Financing

- Accounts Receivable Financing

- Accounts Payable Financing

- Guaranteed Investment Notes

Business term financing

Investors are able to give financing to SMEs businesses.

The tenor ranges between 1 month to 24 months.

The returns range from 8% – 18% p.a. depending on the credit risk of the issuer.

Accounts Receivable Financing

The Issuer sells their future receivables or invoices that the seller’s issue to their customers (“Buyer”) to get immediate cash.

Tenor is in the range of 15 days to 120 days.

Interest = (Interest rate per annum / 360 days) X 20 days.

Accounts Payable Financing

This is an unsecured product used to fund the transaction(s) of the Issuer. For example, purchasing raw materials needed to manufacture steels pipes.

Tenor: range of 15 days to 150 days.

The Service Fee is up to 30% on interest earned, based on the products invested.

Guaranteed Investment Notes (love this product!!)

This investment note actually guarantees your principal & interest.

Interest can range from 4 – 8%

#3: How Much Am I Making?

Just this year, I have earned around RM6K! (Started investing on 4 January 2021)

My annualized portfolio performance (interest) is 11.21% per annum.

To put this interest into perspective,

Bank Savings Account = 0.05% base interest rate (Source: www.imoney.my)

Fixed Deposit = 1.75% (Source: https://loanstreet.com.my)

Funding Societies = 11.21% (before fees and tax)

After fees and tax, the gain from FS is approximately 8% per annum.

Is 8% appealing?

For me, yes.

Even better, it’s 8% compounding interest!

Compounding interest works when your interest grows more interest.

It just means that you continue letting your money make more money for you, without you trading your time for money.

And the amount will gradually increase in the coming years.

The best part: No headaches of the market mood swings/crashes or property management or whatsoever.

If I were to continue depositing and investing at my current speed, the amount would be exponential.

#4: What Is My Risk?

Similar to any other type of investment, there are certain risks involved.

The P2P platform works like a financing supplier (like a banker) and there would be dangers of potential credit defaults and late instalments.

However, here are some ways that Funding Societies manage risk:

- Rigorous Assessment – FS performs a full credit assessment for each and every note issued. They only approve creditworthy businesses.

- Financial Soundness – FS verifies with the credit bureau reports (CCRIS and CTOS scores) of all directors including checks for credit litigation history against the company. [If a company has a bad record, you can be sure that it’ll not be listed in FS]

To reduce risk to as low as possible (even 0), I myself invest heavily into Guaranteed Investment Notes.

#5: How Much Can You Invest?

You may start opening an account and depositing a sum of RM 1,000.

From this sum, you can start investing as little as RM 100 per note into different companies.

If you invest more than RM 50,000, you’ll be considered as an angel investor of FS!

The transaction fee is RM0 (so far to date, 13 Dec 2021).

#6: How To Check Your Portfolio?

Go to menu > portfolio (3rd icon)

Within your portfolio, you may check:

- The total number of investments

- Number of ongoing investments

- Expected returns

- Annualized portfolio performance

- Unpaid repayments

- Expected repayments this month

- Outstanding principal exposure – How much money is currently invested in the notes. It includes how much you’ve deposited into FS + interest gains from past months + bonuses.

- Current principal defaults – How much was defaulted in the notes?

#7: Can You Withdraw Anytime?

Yes, if you would like to withdraw your money (balance cash – You can see this on the top right corner), you may withdraw anytime!

It’ll take around 3 – 5 business days before you see it in your bank account.

However, if the money has been invested into the notes, you’ll have to wait till the tenor ends before you withdraw your money.

#8: How Can You Open An Account?

Signing up isn’t hard at all!

There aren’t any fees to open up an account.

If you’re interested in investing with Funding Societies, you can click on this link.

Disclosure: This is my affiliate link. When you sign up using this link and invest RM 1000, both you and I will be credited an extra RM 30 from FS.

Let’s start investing and make money!

BONUS: If you’re new and you’re unsure of what types of investment notes to invest into…

I’d suggest you start off by investing in Guaranteed Investment Notes.

Read here: How to set up Guaranteed Investment Auto Bot through Funding Societies